Sustained value creation

Supporting decisions that create future value

Corporate & Business Financial Planning (CBFP) provides organizations frameworks and set of tools how to effectively evaluate investment decisions, for example, be they investing into new infrastructure or any assets aiming at reducing firm’s operating costs and/or increasing productivity (e.g., purchasing machinery, computers, software, or trucks) or acquiring a company as part of M&A based growth strategy. We advise and assist SME businesses across all these critical business decisions.

CBFP as a discipline is also crucial for overall corporate and business strategic planning to support the creation of sustainable value for the firm over medium and long-term by simulating, evaluating, and balancing the risks and opportunities involved across three growth strategies:

- Organic growth

- Mergers & Acquisitions, and

- Strategic alliances

To state broadly, CBFP is focused on two basic and very fundamental questions.

The first question is: What real assets should the firm invest in?

This issue comes under the topic of capital budgeting or investment decisions which deals with evaluating investment projects which require investment in real assets such as land, plant and machinery, and new product development.

The second question is: How should the real assets be financed?

This topic broadly comes under financing decisions or capital structure decisions. The financing decision revolves around the combination of debt and equity (share capital) that should be used to finance the investments required in a project. While the cost of debt is lower than the cost of equity, it needs to be balanced with the risk of the possibility that the firm may not have adequate cash flows to pay the interest and principal on the borrowed funds. This could put the firm in financial distress.

Generally speaking, our CBFP and M&A practice area focuses its work on helping clients on these two very fundamental questions.

Contact our CBFP and M&A practice area to learn more how we can help your organization with sustainable value creation

Talk to usFinancial modeling and business planning – what is our approach?

The baseline for CBFP work is financial modeling. Financial modeling is the task of building an abstract representation of a real world financial situation. This abstract representation is called a financial model. A financial model is designed to represent a simplified version of the performance of a financial asset, a project, or any other investment – to gain understanding into economic value added by the investment decision.

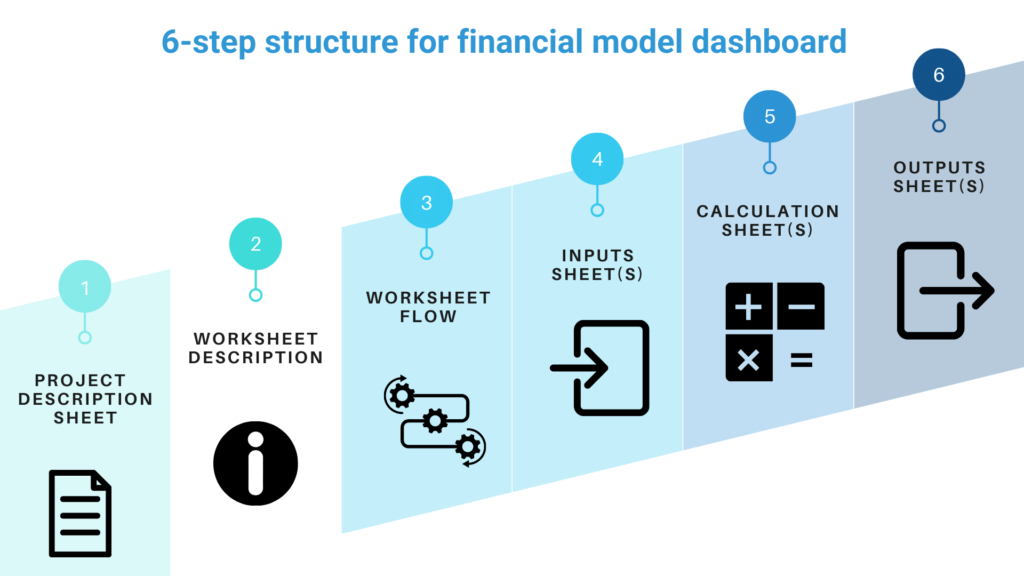

How we approach financial modeling is by utilizing a 6-step structure. The base for any financial model is to first set up the question(s) the financial model should answer. We then define the blank spaces in the story line that the output of the financial model will answer. Equally important is to define what the financial model will not answer. Parallel to this, we will often run so called back-of-the-envelope calculations to give an idea of the final answer(s). Financial models are typically based on an in-depth data from various financial statements, such as income statement, balance sheet, and cash flow statement.

Using a Driver Tree visual we layout the entire financial model with all critical steps that require an analysis. For example, in the case of “value creation for a packaged goods manufacturer” this would include on the capital allocation side everything from cost of capital, capital deployment to aspects such as reducing inventories and improving capital investments, and on the operating profit increase side everything from increasing gross profit, decreasing operating expenses to increasing prices & volumes and optimizing physical networks and using alternative distribution. To answer all required questions, we draw out a schematic indicating inputs, required calculations, and respective outputs.

Typical business problems associated with CBFP

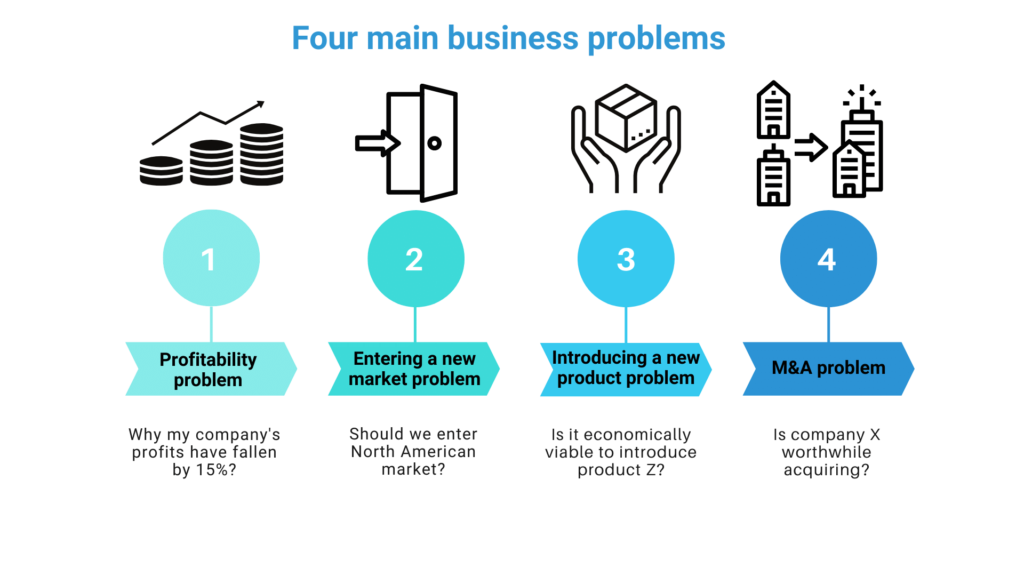

Organizations regardless of the industry typically face four main types of problems as they look to maintain or improve their value creation capabilities. In a broad sense, these are namely related to 1) profitability, 2) entering new markets, 3) introducing new products and/or services, and 4) mergers & acquisitions.

To address these typical business problems, we use a wide toolkit of tools and frameworks for the benefit of our clients. The fundamental idea is to break down a complex, and often asymmetrical, business problem into more digestible elements and give it the required transparency. Through this work corporate and business leaders, such C-suite executives are better positioned to make right operational and/or strategic decisions.

Examples of types of frameworks and tools we deploy

Our toolkit includes number of highly effective corporate financial planning tools and frameworks regularly deployed by world-leading organizations across industries in their critical business decision-making processes, for example Payback period, Net Present Value (NPV), Internal Rate of Return (IRR), NPV vs. IRR, Cash flow-based methods of valuation (DCF), Terminal value analysis, Dividend Discount Model (DDM), Free Cash Flow to the Firm (FCFF), and Free Cash Flow to Equity (FCFE), Profitability, New Market Entry, Product & Service Introduction, and M&A frameworks.

Zoom in profitability framework

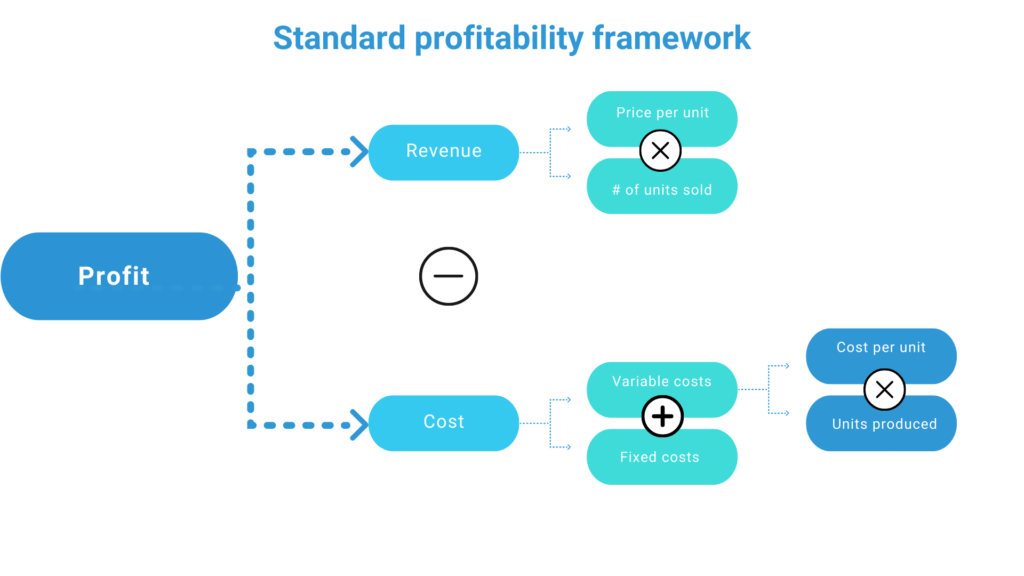

The objective of the profitability framework is to highlight the fundamental drivers of profit in a business. The framework breaks down the problem into smaller pieces to understand the key drivers of the declining profit and to make the contributing factors more transparent.

The framework basically breaks down the profit of a company into this simple equation:

Profit = Revenue – Cost

And then, it breaks down the Revenue and the Cost of the company into smaller pieces. The Profitability framework is very visual way to see what’s wrong.

When applying the Profitability Framework, we always customize it based on client’s industry specifics. In customization, segmentation’s such as product, region, distribution channel, customer type, business unit, and value chain phase (only applicable to break down costs) are typically used. Depending on a specific situation, multiple segmentation’s may be required. For example, it may be necessary to segment both by region and by product. Critical part of the application is to ensure that the tree is Mutually Exclusive and Collectively Exhaustive (MECE). Where Mutually Exclusive refers to all items in each category belonging only to that category and Collectively Exclusive referring to that all the possibilities have been covered.

Learn more how our tools and frameworks can help your business with critical investment decisions by contacting our CBFP and M&A practice area

Talk to us