Sustained value creation

Zoom in mergers & acquisitions framework

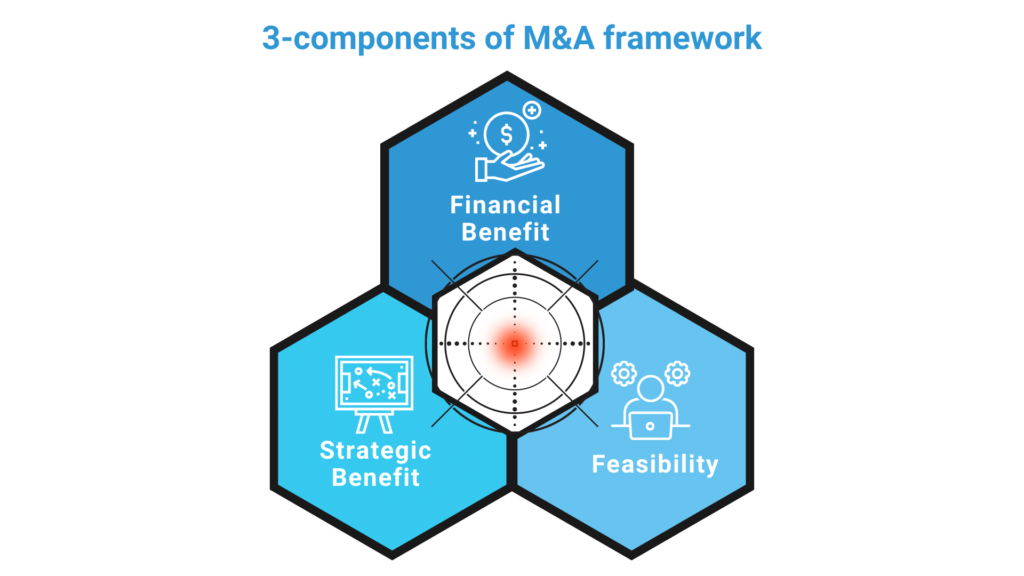

The merger and acquisition framework includes three components that will help to answer questions such as “should company X acquire company Y?”

Each component has an underlying question that will need answering to identify if it is a good strategic initiative to acquire company Y. These questions are:

- What would be the financial benefit of the deal?

- What would be the feasibility of the deal?

- What would be the strategic benefit of the deal?

If the answer is “high” or “very high” to all three questions on a 5-point scale from “very low” to “very high”, then it means that acquiring company Y is a good strategic initiative for company X.

In evaluating the financial benefit, dimension one, we analyze factors such as revenue synergy, cost synergy, integration cost, and return on capital invested (ROCE). On the second dimension, feasibility, we consider factors such as capital requirement, legal requirement, culture, and risks. Strategic benefit, the third dimension, is analyzed based on factors like vision, M&A strategy versus organic growth strategy, and M&A strategy versus strategic alliance.

Subsequently, advantages and disadvantages are analyzed, weighted, and compared across three final organizational alternatives – Organic Growth Strategy, M&A Strategy, and Strategic Alliances Strategy – before final recommendations are provided.

Learn more how our tools and frameworks can help your business with critical investment decisions by contacting our CBFP and M&A practice area

Talk to usValuation process

“Value” from a business sense is about what the customer is willing to pay for. A customer can be willing to pay for a particular product, a service or an information in terms of what it serves their requirements. It could be superior products, it could be a state-of-the-art service, it could be being at the right place at the right time, it could be just being promptness. It need not be technically superior; it just needs to meet what the customer needs are at that particular time for that particular purpose.

In the context of a business, the value of a firm is nothing but a mere number, which represents the present value of future cash flows of the firm. Since the core purpose of any business is sustainable value creation, it is often important to find the intrinsic value of the firm. This then provides the opportunity for the buyers and sellers to trade the company’s stock or make all cash payments, depending on the structure of the deal.

“Value” is about delivering something to the customer that keeps a firm in business. For us, value has a very simple definition. It is two things: One is from a business perspective: the only reason an organization exists is because there is somebody who wants the output of the firm, product or service, and without it, there is no relevance of an organization. Value is generally attached to myriad of concepts like shareholder value, enterprise value, book value, and market value – in other words net asset value. The process of valuing the company and its business helps identify the source of economic value creation for the company.

Context of valuation

First and foremost, valuation plays a very important role in business acquisitions. Investors would be interested in knowing the value of a business before they acquire a stake in the company. Acquisitions usually occur through takeovers, mergers, purchases of a division and so on.

Acquisition of assets; that is another perspective or use of valuation. Companies acquire assets to expand their operations. Acquiring assets include tangible assets like building, equipment, and so on. And it also includes intangible assets such as patents, copyrights, trademarks, and others.

A very interesting application of valuation is also done by venture capitalists. Venture capitalists and equity investors, particularly Private Equity (PE) and so on need to value business before making any kind of investment in startups or scaleups. They take high risks, because high percentage of start-ups fail even before they reach a particular level or threshold of performance (are self-sustaining).

Another very interesting use of this valuation technique is when company raise money through public offerings. Companies decide to issue stocks to the public or “Initial Public offering” (IPO). When companies go public, they need to determine what will be the price at which this issue will happen, so again a valuation technique. Similarly, in the case when a company is going to buy back its shares. Company needs to arrive at the right price at which they will buy back the shares, so again another interesting application of valuation.

How we help businesses with valuation

We have advised and assisted number of businesses globally on valuations – startups, scaleups and SME’s. Our toolkit for valuation, hence, includes various versatile instruments.

Comparable Company Analysis (CCA)

Analysis considers income statement fundamentals – actuals and estimates (growth %) – for revenue, EBITDA, EBIT, net income, earnings per share, and average common shares outstanding as well as stock price, market value, and enterprise value.

Discounted Cash Flow Analysis (DCF)

This in-depth and granular analysis tool focuses on estimating the total unlevered free cash flow, the total net present value of the total unlevered free cash flow, the weighted cost of capital, the terminal value with both the EBITDA and PERPETUITY methods, and finally, the Discounted Cash Flow (DCF) total valuation with both the EBITDA and PERPETUITY methods.

Our view on DCF valuation

In our opinion, the DCF approach makes more sense when you have credible business plans and cash flow projections for the planning period. In DCF evaluation, it is typical to divide future into two parts, the planning period and the balance period. This is how the task is made analytically manageable.

In most of the DCF valuations that we have conducted, the planning period is 5 years, 7 years, or 10 years. Rarely do they exceed 10 years. Hence it can be said that the standard practice is to look at a planning period of 5 years and then look at the remaining period or the balance period. This means that there needs to be credible business plans and cash flow projections for five years. And after five years, it would be assumed that the business would have achieved some kind of stability where cash flows are expected to grow at a constant rate where there is profile remains unchanged, where weighted average cost of capital remains unchanged. With this, the standard Gordon model can be applied.

Based on our experience, very few businesses satisfy these conditions. For example, FMCG businesses satisfy these conditions. Hence, one has to be carefully in applying DCF valuation approach to companies, which do not fulfill these conditions. It is therefore often more practical to rely more on relative valuation or the multiples approach to valuation.

Precedent Transaction Analysis (PTA)

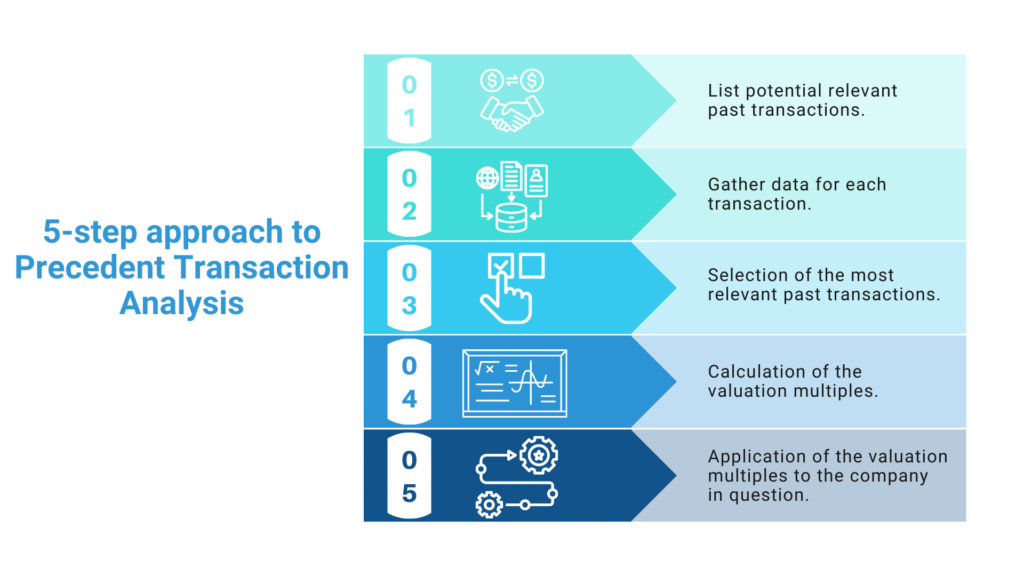

Precedent transaction analysis is a method of company valuation, where past Merger & Acquisition (M&A) transactions are used to value a comparable business today. Commonly referred to as “precedents”, this method of valuation is often used to value an entire business as part of a merger or an acquisition. In this analysis we use a simple, yet very effective, 5-step approach.

Want to learn more about valuation and the tools we have available, contact our CBFP and M&A practice area today

Talk to usHow Venture Capital (VC) and funding processes work, and how we advise businesses in this area? Read more here!

Interested to read more about Post-Merger Integration? Click here!