Due Diligence

Due Diligence – our role

An essential component of any M&A strategy is the planning and execution of Due Diligence (DD). Much like Post-Merger Integration, failure to conduct proper Due Diligence can severely impact the outcome of the deal and the ability to generate future value.

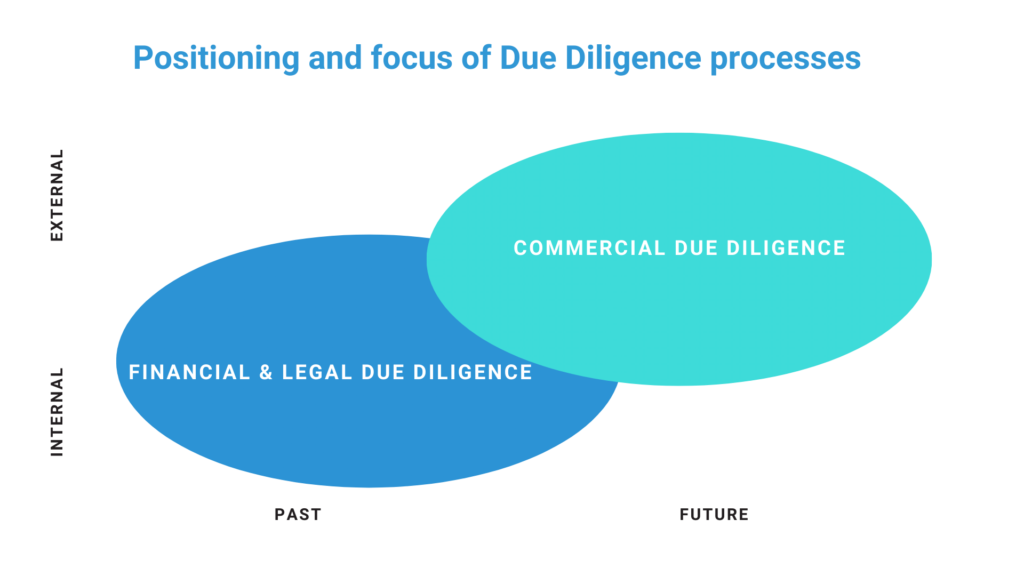

There are three key types of Due Diligence in which our CBFP and M&A and Strategic Planning & Business Innovations practice areas play role in two of those, mainly Financial Due Diligence and Commercial Due Diligence. Legal Due Diligence, the third type, falls to the responsibility of various legal firms.

Financial Due Diligence (FDD) aims at answering the question – “What is the past and present performance of the company?” – whereas Commercial Due Diligence (CDD) aims at the question – “What is the likely future performance of the company?”

The former falls under the responsibility of financial advisory team and the latter under strategy advisory team. Hence, these two areas need coherent communication and number of parallel activities to be successful. Our project management approach ensures this to the highest level.

These three key types of Due Diligence are usually initiated by the acquirer company. However, sometimes the Commercial Due Diligence can be initiated by the Vendor or Seller company. If initiated by Seller company, in such a case the term “Vendor Due Diligence (VDD)” is often used.

Contact our CBFP and M&A practice area to here more how we can advice your business with financial and commercial due diligence processes

Talk to usCommercial Due Diligence (CDD)

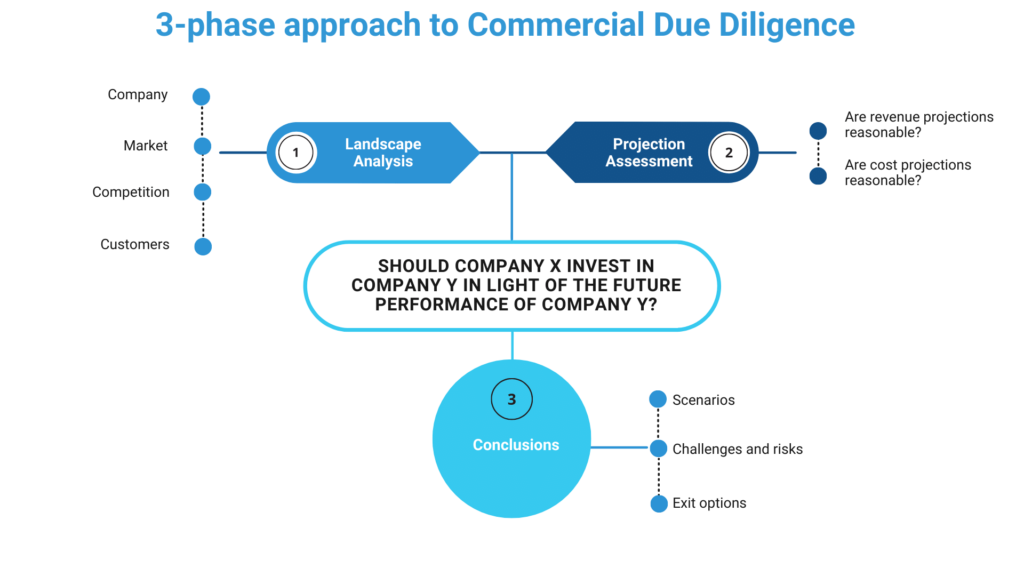

A CDD should help investors answer one key question – should we invest in this company in light of the future performance of the target company?

Our approach to answering this question is to formulate multiple sub-questions using a 3-phase framework

In the landscape analysis we look into factors related to:

- Company

- Market

- Competition, and

- Customers

The company components includes dimensions such as strategy, company key products and services, company capabilities, revenue levels, cost structure, and profitability. In the market part we evaluate factors such as market size and growth, market segments, market segments size and growth, market KPIs, supplier and distribution landscape, and potential threats and opportunities. On competition we analyze the competitive intensity and company’s position in each market(s). The final part involves an analysis of customers where we look into segmentation, Willingness to Pay (WTP) by the customers for the company’s products and services, purchasing behavior, and trends.

After the landscape analysis, we conduct a projection assessment. This includes evaluating whether revenue and cost projections are reasonable by means of analyzing company revenue drivers, past revenue growth, future revenue growth, company cost drivers, and past and future COGS & operating costs.

The final part of the assessment involves conclusions and recommendations. Here we simulate various scenarios (typically three; base, downside, and upside), determine challenges and risks as well as make considerations for exit options.

The benefit is that the approach is simple and structured.

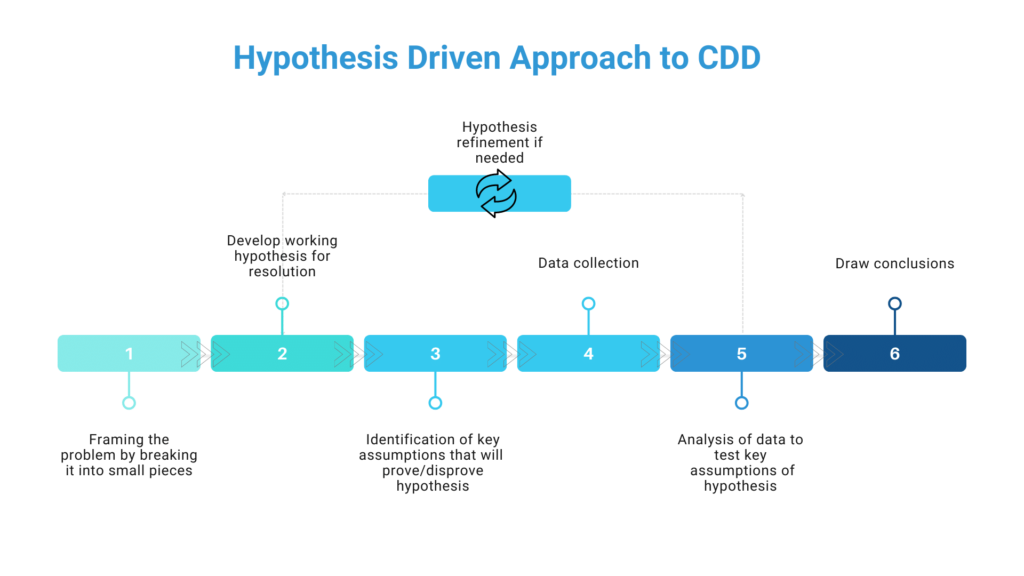

When we undertake CDD assignments, we typically use a technique called Hypothesis Driven Approach as depicted below. The benefit is that the approach is simple and structured, ensuring that the complexity of the topic is broken down into transparent and logical components for easier follow-through with clients.