1 + 1 = 3

Mergers & Acquisitions (M&A)

One of the central growth strategies of businesses is Mergers & Acquisitions (M&A). M&A brings together companies through complete changes in ownership. They have been used by companies for centuries and remain a major way for companies to expand rapidly, either through vertical or horizontal integration within existing industry vertical or entering entirely new industries.

Based on our work on the M&A arena, we have come across numerous advantages, but also disadvantages that M&A strategy offers.

On the advantages side we can firstly say it allows business extension, in which M&A can be used to extend the reach of a firm in terms of geography, products, or markets. Secondly, building capabilities as a firm may acquire core-competencies that it currently does not have. Thirdly, M&A may result in increase market power by reducing competition and increasing bargaining power with suppliers. Fourthly, increase efficiency through sharing of resources and capabilities. In addition, speed (allows acquirers to act fast) and financial efficiency (combination of two balance sheets) can be significant advantages. In some cases, there can also be significant tax advantages and efficiencies behind M&A decisions.

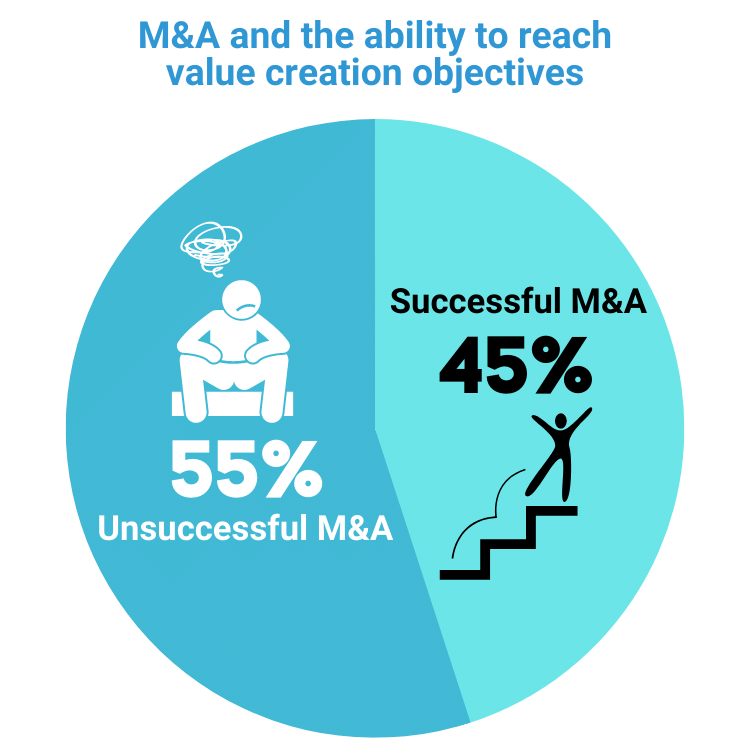

On the other hand, disadvantages include massive upfront investments and potential culture clashes of combining two, often very different, cultural landscapes together. M&A strategies tend to also have very high failure rates, as we have just recently concluded in our research into M&A activities by SME’s Europe (access the commentary here). Our findings are to large degree supported by findings from various surveys conducted for example by The New York Times and Harvard Business Review that state that “more than half (55%) of M&As fail to reach their value creation objectives.”

M&A strategies tend to have a very high failure rates.

Finally, it can be said that sometimes there exists excessive initial valuations, exaggerated expectations of strategic fit, and underestimated problems of organizational fit.

More on M&A, contact our CBFP and M&A practice area for advice

Talk to usHow to increase success rate of M&A – our solution

To mitigate the risks of M&A strategies, we have effectively deployed 6-step framework with number of our clients over the years.

While there are many alternative routes to conducting M&A strategies, we have found that many of these fail in the most crucial aspect, hence failing to deliver value creation objectives. In our opinion and concluded by our recent work in this area – the most crucial factor is indeed Post-Merger Integration.

“Our research confirms that post-merger management is indeed the single most important determinant of acquisition success. Companies displaying weak post-merger management reduce their likelihood of creating value to just 30%.”

More on our research findings, download “Generating Value Through Acquisitions” Commentary here.

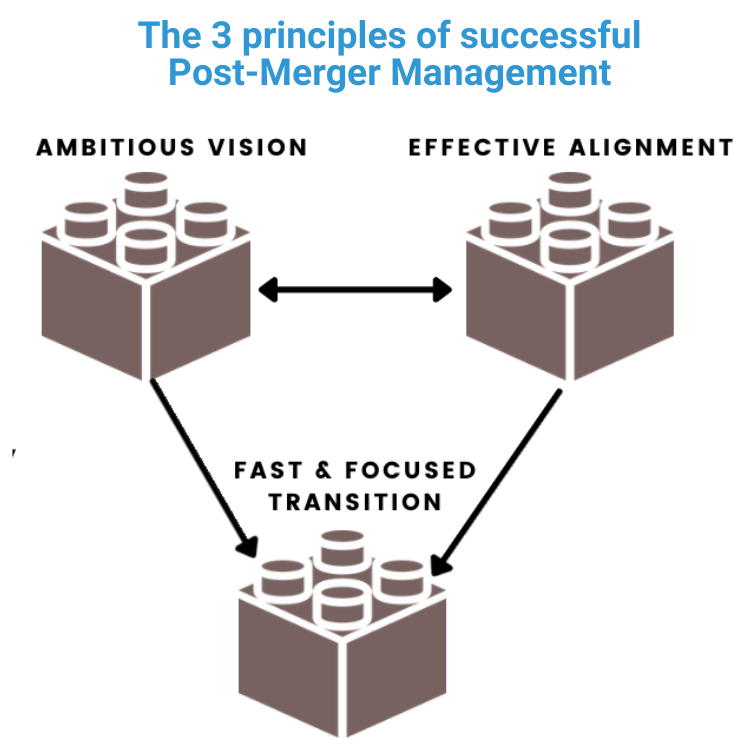

What makes for good Post-Merger Management? Certainly, experience is helpful. Based on our research, companies that completed six or more mergers outperformed their respective industry average in 74% of all cases, versus only 52% for companies completing between one and five deals. But experience is by no means the only factor. An examination of those companies that have successfully used acquisitions to generate profitable growth reveals that strong Post-Merger Management has three characteristics as depicted in the diagram.

Contact our CBFP and M&A practice area to learn more how we can help your organization with Post-Merger Integration planning and execution

Talk to usPost-Merger Integration

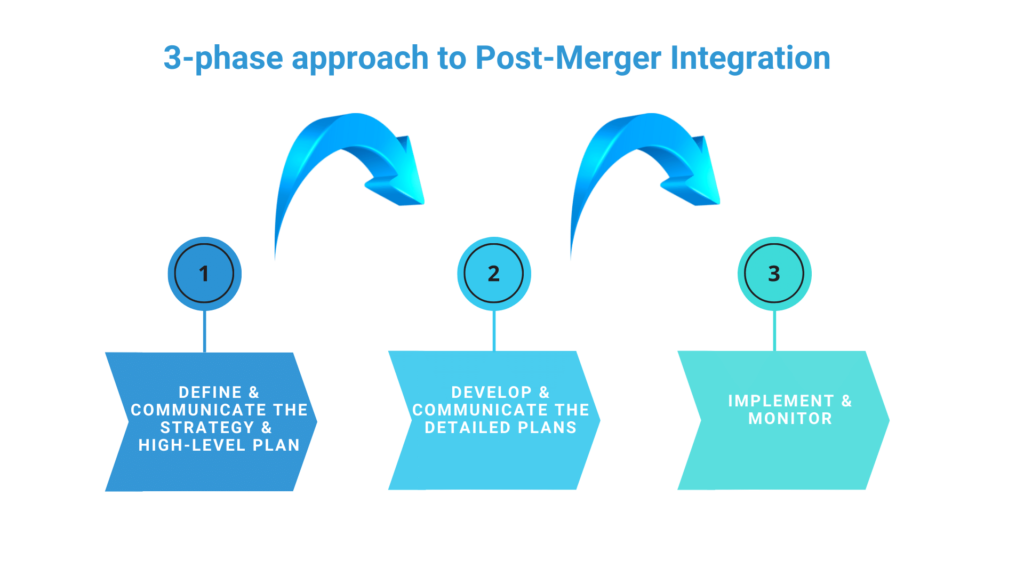

To make Post-Merger Integration more successful, we have worked with companies using a simple, yet powerful, 3-phase approach.

The very success of Post-Merger Integration depends on quality project management combined with effective integration tools. Hence, to ensure proper execution of the integration and synergy initiatives, it is very important to appoint high-caliber initiative owners or project managers that work to mitigate the main challenge – to meet the objectives while balancing the triple constraints of quality, cost, and time.

Read more on the importance of Post-Merger Integration from our latest research here!