101 of Venture Capital

Our CBFP and M&A practice area also works with startups and scaleups as part of their fund-raising processes. The ability to raise capital is pivotal for the success of a new venture at various conjunctions during the life-time of the venture, especially before the business is self-sustaining (it is able to generate enough revenues to support its cost structure AND to make required profit margins).

Unfortunately, though, many new ventures and entrepreneurs are ill-equipped to raise capital putting the entire business at risk. On the other hand, even though today there is more “risk capital” available globally than maybe ever before, raising capital has become more and more difficult during the past years as investors, Venture Capitalist (VC) and Private Equity (PE) alike, are increasingly more prudent with where they invest their money. It is also important to note that raising capital increases in complexity at each subsequent round starting from Pre-Seed.

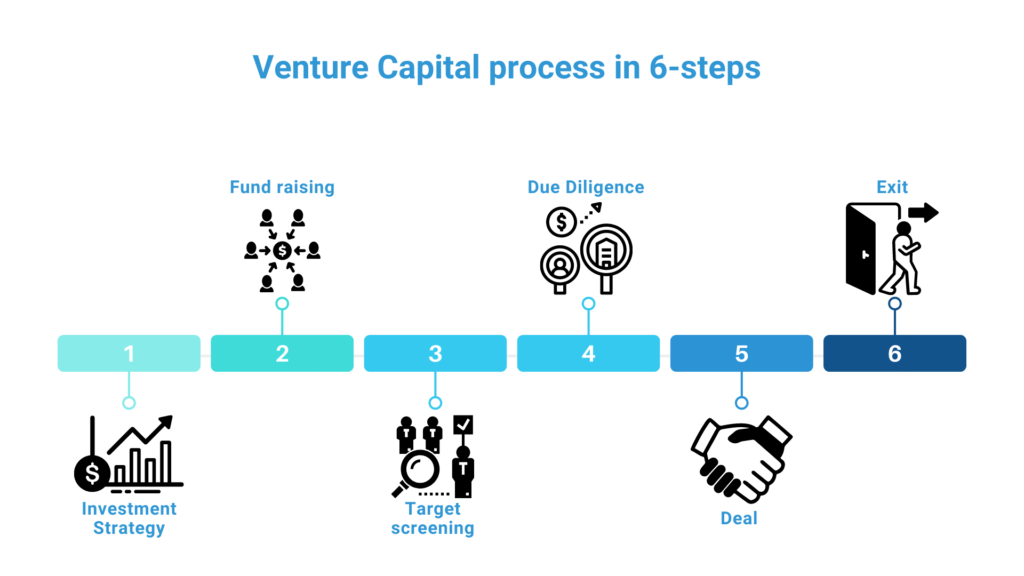

To make entrepreneurs and scaleup businesses more equipped about the VC process, we have put together a video tutorial based on our experience in working as part of capital raising rounds. You can access the tutorial series here.

Is your business in need of capital raising? Contact our CBFP and M&A practice area to hear more how we can advice with the process

Talk to usRaising capital – the key points to consider

When raising capital for a new venture, there are multiple questions that need to be answered and prepared for in any type of financial discussions. Here we have outlined some of the key points that should be noted and which we have come across numerous times.

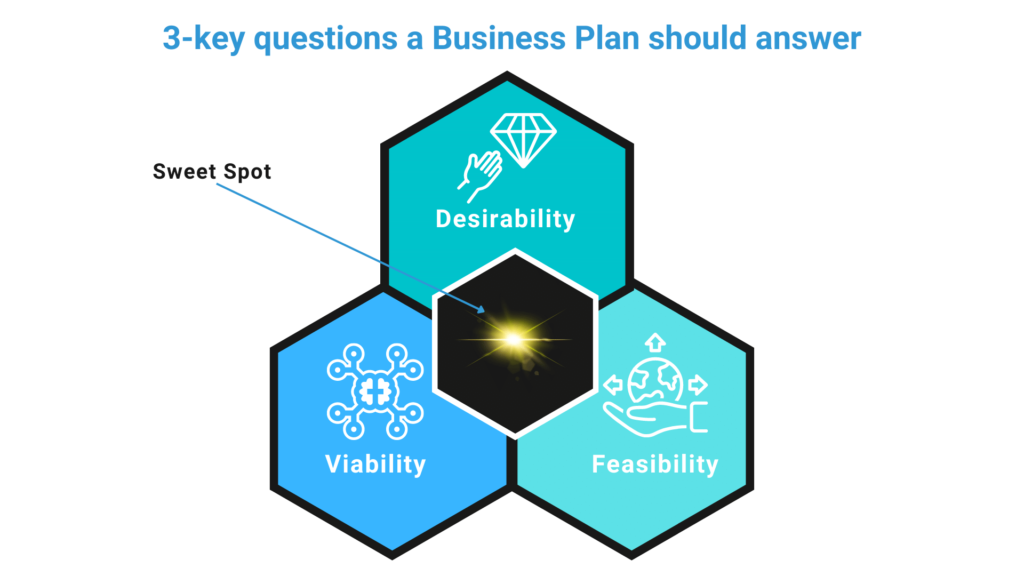

- To achieve the “sweet spot” from an investment perspective, the business plan should answer three relevant questions:

- Is the business viable?

- Is the business feasible?

- What is the desirability of the products / services provided by the business?

- When preparing the Term Sheet with investors, it should embody overall conditions of the business agreement that covers:

- Post-money valuation

- Amount of financing

- Investors names

- Size of option pool

- Vesting periods

- Board representation

- Additions to management team (if applicable)

- The typical roles that VC’s take in a venture’s include:

- Board involvement

- Management recruitment

- Capital raising

- Access to business network

- Strategy development

- It is important to distinguish between pre-money valuation and post-money valuation. The pre-money valuation is the valuation of the business before the VC investment and the post-money valuation is the valuation of the business after the VC investment. Take for example, if business A is worth $5MM and the VC decides to invest $2MM, it means that:

- Pre-money valuation of business A = $5MM

- Post-money valuation of business A = $7MM ($5MM + $2MM)

- The three growth strategies that a new venture needs to evaluate as part of its strategy-making are:

- Organic growth

- Growth through M&A

- Developing strategic alliances

- When preparing valuations, three most often used techniques should be considered and the most optimal for the specific life-time situation and conditions of the business chosen:

- Discounted cash flow

- Comparable Company Analysis, and

- Precedent transactions analysis